Australian property market approaches $12 trillion as national price momentum builds

Overview

- The total value of Australian residential real estate is now $11.8 trillion.

- National housing values are gaining momentum, rising 2.2% over the September quarter alone.

- Darwin markets are setting the pace for capital growth since the first interest rate cut in February, with suburbs like Wanguri and Durack (NT) soaring by 20.1%.

- Conversely, Sydney and Melbourne accounted for the majority of areas experiencing a dip in value since the rate cuts began.

Australia’s property market has reached a new milestone, with the total value of residential real estate climbing to $11.8 trillion for the first time, increasing by $678 billion over the past 12 months, according to Cotality’s October Monthly Housing data.

The milestone comes as momentum in national housing values continues to build, with dwelling values up 2.2% over the three months to September. This is the largest quarterly increase since the three months to May 2024 (2.2%).

The annual growth trend also shifted higher for the fourth consecutive month, up from a low of 3.7% over the 2024-25 financial year, to 4.8% in the 12 months to September.

This $11.8 trillion milestone is a clear testament to the resilience of Australia’s property market, where national dwelling values are now up 4.8% over the past year.

There’s a clear building of momentum, with a 2.2% rise over the September quarter alone, the largest quarterly increase since May 2024.

At the moment, there’s some uncertainty around the timing of another cash rate reduction and inflation impacting market momentum through to the end of the year. However, if the property market were to continue at its current rate of growth, it’s possible the combined market value could hit $12 trillion by the end of the year.

Which market values have changed the most (or least) amid rate cuts so far?

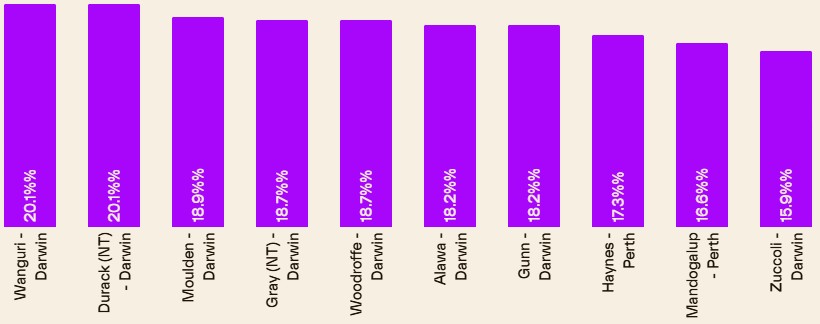

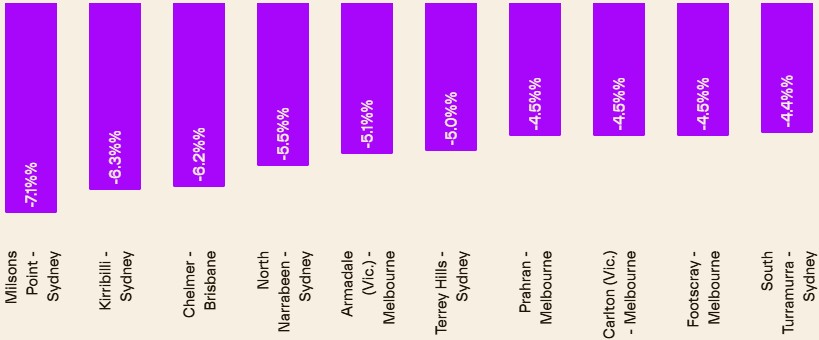

Largest and smallest change in suburb dwelling values between 28 February 2025 and 30 September 2025

Highest change – CAPITALS

Source: Cotality

Lowest change – CAPITALS

Source: Cotality

Highest change – REGIONALS

Source: Cotality

Lowest change – REGIONALS

Source: Cotality

Drilling down into the performance of individual suburbs reveals where the market has thrived most decisively since the first interest rate cut in February.

This period, between the end of February and September 2025, highlights the markets responding strongest to lower borrowing costs and tight supply.

Cotality’s analysis of suburb level dwelling values since February shows a clear trend: Darwin markets are setting the pace for capital growth.

Suburbs like Wanguri and Durack (NT) both led the nation with outstanding growth of 20.1% in that time. This surge in Darwin suburbs reflects a powerful combination of relative affordability, extremely low levels of housing supply and a notable lift in investment activity.

Conversely, Sydney and Melbourne accounted for the majority of areas experiencing a dip in value since the rate cuts began. The largest declines were concentrated in inner city, lifestyle suburbs, primarily those with high density unit stock. Milsons Point in Sydney saw the greatest fall at −7.1%, with Kirribilli close behind at −6.3%.

This reflected market dynamics more broadly.

Even though the suburb analysis is hyper local, the data highlights a broader trend of Darwin leading Australia’s capital growth trend. City home values are up 13.4% through the year to date. It’s a relatively affordable market and investors may be taking note of high yields and rapid value increases. Some of the top performing regional markets were also the most affordable, such as Boggabri in regional NSW and Rochester in regional Victoria, each dwelling market with a median below $400,000.

With other capital city and major regional markets soaring in value over the past few years, it seems like buyers are targeting what is left of the affordable land and housing across the country as interest rates fall and rents reaccelerate.

Other highlights include:

- The strongest quarterly pace of growth has rippled from the lower quartile of the market (2.4%) to the broad middle (2.5%). Nationally, the ‘middle’ of the market is dwellings valued between $648k and $1.2m.

- Outside of Darwin, where values rose 5.9% in the September quarter, the ‘midsized’ capitals continued to lead growth, with Perth home values up 4.0%, Brisbane up 3.5% and Adelaide up 2.5%.

- Cotality estimates 44,436 sales occurred nationally in September, taking the rolling 12 month count to 540,775. Annual sales were roughly in line with the number of sales this time last year.

- The amount of time it takes to sell a property by private treaty has increased year on year to 30 days nationally but results vary depending on the market. For example, the recent strength in the Darwin market has driven down selling times from 51 days in the September quarter last year to just 39 days. In Melbourne, selling times have fallen from 35 to 32 days year on year.

- The discounts offered by sellers are generally smaller than they were a year ago amid rising buyer activity and low stock levels. The vendor discounting rate shrank from 3.3% in the September quarter last year to 3.2% in the three months to September 2025.

- Total stock levels have moved subtly higher in the past four weeks, with just 122,173 properties observed for sale nationally over the four weeks to October 5. Since the start of spring, total listing levels have risen 2.7%. However, stock levels generally remain tight, sitting -19.3% below the historic five-year average for this time of year.

Source: Cotality